Medicare Supplement plans are also known as Medigap plans. Currently, 47 states offer 10 standardized Medicare Supplement plans that are designated by the letters A through N (plans E, H, I, and J are no longer sold). The private insurance companies that offer these plans are not required to offer every Medicare Supplement plan, however they must all offer at least Plan A. If an insurance carrier decides to offer Medicare Supplement plans in addition to Plan A, the carrier must offer either Plan C or Plan F along with any other standardized Medicare Supplement plans it provides.

Please note that despite the fact that the names may sound similar, the “parts” of Medicare, such as Part A and Part B, are not the same as Medigap Plan A, Plan B, etc.Medicare Supplement Plan Coverage

Each Medicare Supplement plan provides a different level of coverage, but each lettered plan must incorporate the same standardized benefits irrespective of insurance carrier and location. For eample, Medicare Supplement Plan G in Florida includes the same benefits as Plan G in North Dakota. However, if you reside in Massachusetts, Minnesota, or Wisconsin, your Medicare Supplement insurance options are different than in the rest of the country. Medicare Supplement plans do not cover vision, dental, long-term care, or hearing aids, but all plans must cover at least the required basic benefits:

- Medicare Part A coinsurance costs up to an additional 365 days after Medicare benefits are used up

- Medicare Part A hospice care coinsurance or copayments

- Medicare Part B coinsurance or copayments

- The first three pints of blood used in a covered medical procedure.

Many plans include additional coverage. For instance, Medicare Supplement Plan F, the most comprehensive standardized plan, provides these additional benefits:

- Coverage for the Medicare Part A deductible

- Coverage for the Medicare Part B deductible

- Part B excess charges

- Part B preventive care coinsurance

- Coverage for Skilled Nursing Facility (SNF) care coinsurance

- Foreign travel emergency care (80% of Medicare-approved costs, up to plan limits)

- Some plans may come with additional innovative benefits.

Medicare Supplement Plan Comparison

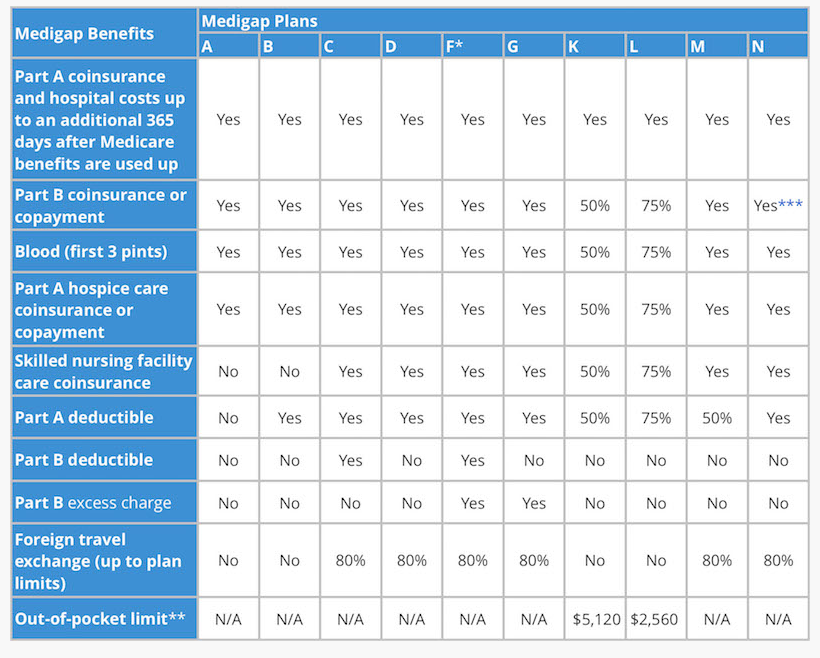

This table highlights the different Medicare Supplement Insurance plans and Coverage:

* Plan F also provides a high-deductible plan, usually at a lower monthly premium. You must pay all Medicare-covered costs up to the deductible amount of $2,240 in 2018 before your Medicare Supplement plan pays anything. Once the deductible is met, the plan provides the same coverage as a standard Plan F.

** After your annual Part B deductible and out-of-pocket annual limit are met, the Medicare Supplement plan pays 100% of your covered services for the remainder of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission.

Eligibility and Enrollment

To be eligible to enroll in a Medicare Supplement plan, you must already be enrolled in both Medicare Part A and Part B. Tthe best time to enroll in a Medicare Supplement plan is during the Medicare Supplement Open Enrollment Period, beginning the first day of the month that you are both age 65 or older and enrolled in Part B, and the open enrollment period lasts for six months.

During the open enrollment period, you have the guaranteed-issue right to join any Medicare Supplement plan available where you live without a requirement of insurability. You cannot be refused coverage based on any pre-existing conditions during this open enrollment period (although a waiting period may apply). If you miss this enrollment period deadline and try to enroll in the future, you could very well be refused coverage or charged a higher premium based on your medical history. In some states, you may be able to enroll in a Medicare Supplement plan before the age of 65.

Speak with an experienced advisor!

Speak with an experienced advisor!