According to Medicare.gov, Medicare Supplement Insurance (Medigap) is insurance that is sold by private companies to help pay for some of the health care costs that Medicare doesn’t cover. Typical gaps in Medicare are copayments, coinsurance, and deductibles.

The Complete Guide to Medicare Supplement Insurance. 1

What Medicare Covers. 1

What Medicare Doesn’t Cover. 2

Medicare Part D (Drug Coverage). 2

Medicare Supplement Insurance (Medigap). 3

8 Important Things to Know About Medicare Supplements (Medigap). 3

What Medicare Supplement Insurance Does Not Cover. 3

Ten Medicare Supplement Plans that are Approved by Medicare. 3

Insurance Plans that are not Approved Medicare Supplements. 4

How to Drop Your Medicare Supplement (Medigap) Insurance (Not just the Drug Coverage). 4

When to Purchase Medigap Insurance. 5

Where to Buy Medicare Supplement Insurance (Medigap). 5

Can I Switch Policies and/or Companies?. 5

Buying Medigap Insurance outside the Protected Enrollment Period. 6

What if I have Pre-existing Conditions. 6

What Does Medicare Supplement Insurance (Medigap) Cost. 6

What Medicare Covers

Medicare is the health insurance program provided by the government that you have been paying into your entire working life. It includes two major programs; Part A and Part B.

- Medicare Part A

Part A of the program pays for five different categories of health care.

- Hospital care expenses

- Costs for skilled nursing facility care

- Nursing home care

- Hospice

- Home health services

Like traditional insurance policies, Medicare Part A has deductibles and copays that must be assumed by the patient, either through out-of-pocket payments or other insurance. For 2017, the inpatient hospital deductible is $1,316, plus daily coinsurance of $329 for days 61 through day ninety. For skilled nursing facility care, the coinsurance is $164.50.

- Medicare Part B

Part B of the program covers expenses like doctor visits, lab tests, surgeries, and medically necessary supplies such as wheelchairs, walkers, and braces. Part B also pays for preventative services such as flu and pneumonia vaccines.

Although Medicare Part A does not require a monthly premium, the Part B premium averages about $134 per month for the coverage and the patient is also responsible for 20 percent of the Medicare-approved amount of healthcare expenses.

What Medicare Doesn’t Cover

Although Medicare is considered comprehensive medical insurance, there are certain services that are not covered under Part A or Part B. These non-covered services will require the patient to pay out-of-pocket or purchase supplemental insurance to cover the gap.

Typical medical services that are not paid by Medicare and are the responsibility of the patient are:

- Long term or custodial care

- Most dental expenses

- Eye exams related to prescribing glasses

- Cosmetic surgery

- Acupuncture

- Hearing aid and exams

- Routine foot care

To verify if Medicare will pay for a test, item, or service, Click Here.

Medicare Part D (Drug Coverage)

Part D or PDP coverage is purchased from a Medicare-approved private insurer. Your premiums depend on the plan you purchase and the company you purchase from. Plans can vary based on the prescription drugs you require and the geographic area you live in.

Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance (Medigap) is sold by private insurers and is designed to fill the gaps in the Medicare Part A and B plans. The gaps that are typically covered are copayments, deductibles, and coinsurance costs. Having Medicare Supplement Insurance helps eliminate the out-of-pocket expenses associated with health care. Some Medicare Supplement policies offer additional coverage for services that Part A and Part B do not cover such as coverage for medical services received outside the U.S.

8 Important Things to Know About Medicare Supplements (Medigap)

- You must sign up for Medicare A and B before you apply for Medicare Supplement Insurance.

- Even if you have a Medicare Advantage Plan, you can still apply for Medicare Supplement Insurance as long as you can leave the Medicare Advantage Plan before your Medicare Supplement Insurance begins.

- You are responsible for your Medicare Supplement insurance premium along with your Medicare Part B premium.

- Medicare Supplement policies do not cover both spouses. Each must have their own policy.

- You are allowed to purchase Medicare Supplement Insurance from any company licensed and approved to offer it in your state.

- All Medicare Supplement Insurance policies are guaranteed to renew, even if you have gotten ill during the period. The insurer cannot cancel your coverage as long as you pay the periodic premium.

- All Medicare Supplement Insurance policies issued after January 1, 2006, cannot include prescription drug coverage. This coverage must be purchased in a separate Part D plan from an approved insurer.

- It is illegal to purchase Medicare Supplement Insurance (Medigap) if you have a Medicare Medical Savings Account.

What Medicare Supplement Insurance Does Not Cover

Although Medicare Supplements are designed to fill the coverage gap in Medicare Part A and Part B, they do not cover every medical service. Important services that are not covered are:

- Long-term care

- Expenses incurred from eye exams, eyeglasses, and contact lenses.

- Dental expenses including office visits.

- Expenses for hearing exams and hearing aids.

- Private nursing

Ten Medicare Supplement Plans that are Approved by Medicare

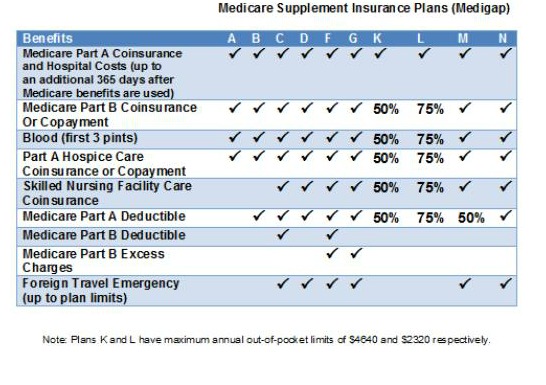

Currently, there are ten standardized Medicare Supplement Insurance Plans available for purchase in most states. Starting with Plan A and going through Plan N, each plan offers different coverages and different levels of coverage.

It’s important to note that the states of Massachusetts, Minnesota, and Wisconsin have different standardized plans than those listed above.

Insurance Plans that are not Approved Medicare Supplements

All Medicare Supplement (Medigap) plans must be approved by Medicare before they can be sold as Medicare Supplement Insurance. Plans that are often confused with Medicare Supplements are:

- Medicare Advantage Plans

- Medicare Prescription Drug (Part D) plans

- Medicaid

- Plans offered by employers or unions

- TRICARE (military health insurance)

- Veteran’s benefits

- Long-term care policies

- Indian Health Service plans

How to Drop Your Medicare Supplement (Medigap) Insurance (Not just the Drug Coverage)

It’s important to be careful about how and when you cancel or drop your Medicare Supplement Insurance, especially if your intentions are to change plans or the company you are purchasing it from. If not done properly, you could end up paying a significant penalty if you drop the entire plan and the drug coverage wasn’t “credible prescription drug coverage” or if you go 63 consecutive days or more before your new Medicare drug coverage begins,

When to Purchase Medigap Insurance

Medicare provides a six-month open enrollment period for Medigap purchases. During the open enrollment period, you are not subject to medical underwriting so there should be no concern about health issues. Open enrollment starts the month you turn 65 and enrolled in Medicare, and runs for six months thereafter. Your open enrollment period is important and if not properly considered, your insurance could cost you substantially more.

Where to Buy Medicare Supplement Insurance (Medigap)

Medigap policies may be purchased from an insurance broker or company agent who is licensed to offer insurance in your state. Most insurance brokers represent multiple Medigap insurance carriers and also specialize in the senior insurance market.

Since insurance brokers represent multiple carriers, they have the ability to shop your plan with all their carriers and offer the most affordable solution to fit your individual needs. Since insurers are not required to offer every plan approved by Medicare, it makes more sense to go through a broker rather than a company agent. Also, it’s important to note that the broker is paid by the insurance company and not by the applicant.

Can I Switch Policies and/or Companies?

There are several reasons that you may want to switch Medigap plans:

- You may believe you are paying for benefits you don’t need.

- You do not have enough benefits.

- You are satisfied with your benefits but not the insurance company.

- You want a less expensive policy

There are certain provisions that will allow you to change plans and insurance companies without having to worry about health questions.

- If you are eligible under specific circumstances or you qualify under guaranteed issue rights.

- You are within the six-month Medigap open enrollment period.

Buying Medigap Insurance outside the Protected Enrollment Period

Typically, you will run into problems if you attempt to purchase Medigap insurance outside of the protected enrollment periods. The insurance carrier can refuse to offer coverage or may only let you make a purchase if you medically qualified. If an approved carrier does agree to offer you coverage, you’ll likely have to pay a higher rate and the carrier can also place a six-month waiting period before they will cover pre-existing conditions.

What if I have Pre-existing Conditions

It’s important to note that under Medicare rules, Medigap policies are not required to cover pre-existing conditions during the first six months of coverage unless you have a guaranteed issue right (you are 65 or older and lost prior insurance within 63 previous days) or purchase your coverage during an open enrollment period.

What Does Medicare Supplement Insurance (Medigap) Cost?

As with any health insurance policy, the coverage you select, the company you choose, and the state you live in will have a factor in your pricing. You can easily shop your coverage at Medicare.gov and then contact a broker in your state to get details on the available plans and then make an informed decision.

Speak with an experienced advisor!

Speak with an experienced advisor!