Most seniors who begin shopping for Medicare Supplement Insurance feel like their choice is an easy one since all plans must be alike. Knowing this, many people feel that the price should be the deciding factor and therefore shopping their insurance should be a quick and easy process.

Although we agree that shopping for Medicare Supplement Insurance should be quick and easy, there is more to consider than just pricing. Many insurers who are approved to offer Medicare Supplement Insurance differentiate themselves from their competition by offering extra services, outstanding customer service, and fast claims service. Here we’ll discuss Medicare Supplement Insurance from Mutual of Omaha.

About Mutual of Omaha

Mutual of Omaha, one of America’s most popular insurance companies, was founded way back in 1909 by Harry S. Weller. Mr. Weller served as the company’s original President until 1932. From it’s founding in 1909 until today, Mutual of Omaha’s footprint has grown consistently and profitably because of the company’s conservative vision and its willingness to make acquisitions that will help them serve the public and the financial products hard-working men and women depend on.

Most people will associate the company’s name with the Wild Kingdom television show which was hosted by Marlin Perkins until he died at the age of 81.

Today, Mutual of Omaha operates and offers products through six subsidiary companies:

- Companion Life Insurance Company – offers live insurance products in the state of New York.

- Mutual of Omaha Investor Services – the company’s broker-dealer company that offers mutual funds directly to consumers.

- United of Omaha Life Insurance Company – United offers life insurance, annuities, Medicare Supplements, and various other financial products.

- United World Life Insurance Company – specializes in Medicare Supplement Insurance.

- Omaha Insurance Company – founded in 2006 and offers Medicare Supplement Plans.

- Omaha Financial Holdings – Mutual of Omaha’s holding company that oversees banking operations.

Mutual of Omaha’s Financial Ratings and Stability

Mutual of Omaha and its subsidiaries continue to enjoy sound financial ratings from all of the major rating services:

| A.M. Best Company, Inc. | A+ Superior – Second highest out of 16 |

| Moody’s Investors Service | A1 Good – Fifth highest out of 21 |

| Standard & Poor’s | AA- Fourth Highest out of 21 |

| Better Business Bureau | A+ |

Medicare Supplement Insurance from Mutual of Omaha

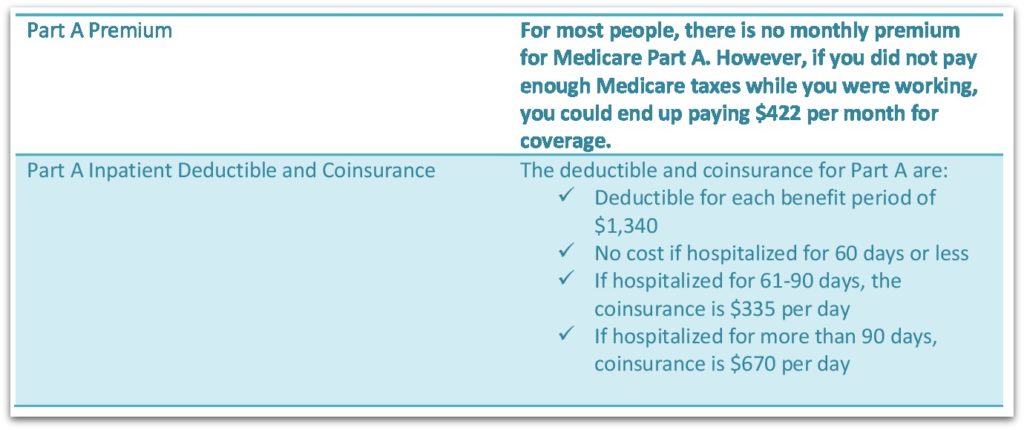

If you have discovered this article online, it’s safe to assume that you are enrolled in Original Medicare now or that you will be in the near future. Either way, it’s highly likely that you understand the Original Medicare has gaps in its coverage because of copayments that are required, coinsurance that is required, and deductibles that will apply to Part A and Part B.

These insurance gaps will turn into out-of-pocket health care expenses that are your responsibility when you visit your doctor or admitted to the hospital. Although most people expect some out-of-pocket health care expenses, many want to make certain that they can fit them into their budget. When expenses are unknown, it can be very difficult to plan for them in advance.

When you buy a Medicare Supplement plan to plug the gaps in Original Medicare, you can substantially reduce your healthcare expenses and plan for the insurance premiums, giving you more control over your healthcare expenses. Why be uncertain about your health care costs when you can transfer that uncertainty to a highly-rated insurance company?

Original Medicare Coverage Gaps for 2018

Part A (Hospital Insurance)

Even though most people don’t typically spend 60 days in the hospital during one benefit period, consider how much it would cost if you did spend 61 days or more.

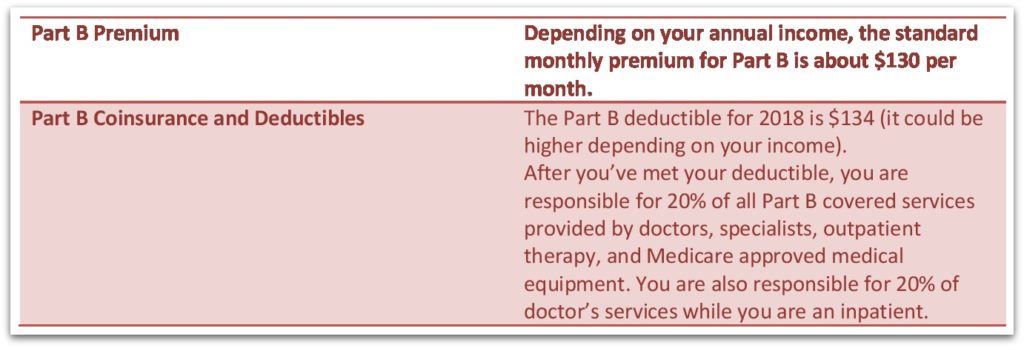

Part B (Outpatient Coverage)

Unfortunately, a lot of seniors don’t realize how much 20% can amount to. Consider how much 20% could add up to if you had to see a doctor and a specialist several times per year. For many seniors that 20% could end up being financially devastating because that money has to be paid right out of your pocket. You can easily transfer that risk to a highly-rated health insurer instead of worrying whether you can pay your share of the doctor bills.

Medicare Supplement Plans from Mutual of Omaha

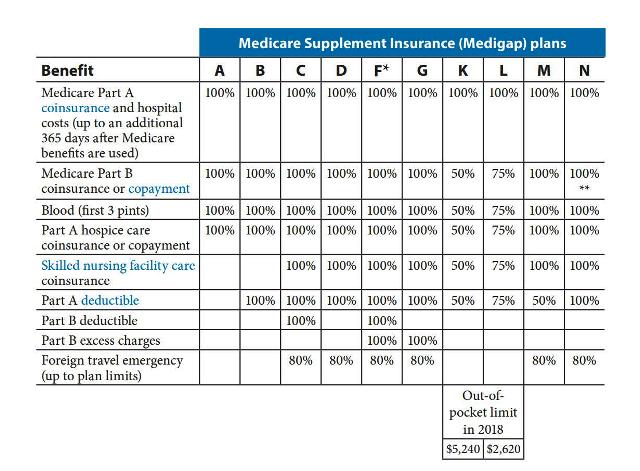

In order to help you see what each plan offers, we have listed the plans below so you can make a side-by-side comparison of the coverages available for each plan. Although almost all states have authorized the same plans, Massachusetts, Minnesota, and Wisconsin have different plans that they have authorized for sale in their respective states. In these three states, your choices are somewhat limited but it is still worth transferring your risk nonetheless.

Honestly, we understand there is a lot to consider so why go it alone? You can easily contact an experienced and reputable insurance broker to walk you through all your options and help you make an informed decision about your health care coverage.

Speak with an experienced advisor!

Speak with an experienced advisor!