As soon as you have enrolled in Original Medicare Part A and Part B you will have the option to fill in the coverage gaps with a Medicare Supplement plan. There are numerous insurance companies to pick from and every one of them has to offer the same core benefits, but many provide additional coverages and other bells and whistles. In this article, we’ll review Medicare Supplement plans from Cigna.

Cigna consistently stands out as one of the leading Medicare Supplement providers and continues to be a prominent choice for senior citizens across the country. The company offers very reasonable pricing and offers excellent customer service and claims service to their customers and medical providers. After investing a little time and energy learning about the different carriers that offer Medicare Supplement plans in your state, you will undoubtedly be at an advantage when it’s time to a make a purchase selection.

An Overview of Cigna

Even though Cigna unveiled its prevailing company name in 1982, the insurance company’s beginnings can be traced back more than two hundred years. By completing historic acquisitions Cigna has become a global insurer with over 15 million subscribers worldwide.

Through disciplined leadership and its dedication to maintaining excellent consumer benefits, Cigna enjoys particularly high financial ratings for the insurance company and its subsidiaries:

| Rating Service | Assigned Rate |

| A.M. Best |

A |

| Standard & Poor’s |

AA- |

| Moody’s |

A1 |

| Fitch |

A+ |

Why Choose Signa?

It’s important that consumers understand that all Medicare Supplement plans must consist of the same coverages in each plan available. Knowing this, you will probably presume that price is the only distinction from one insurer to another; however, there are various important factors to look at about Cigna that distinguishes them from the other Medicare Supplement insurers.

- Product and service rating organizations agree that Cigna Medicare Supplement plans continue to rate extremely high based on customer satisfaction surveys. Cigna has consistently invested in technologies that allow the company to offer their insurance products in a very efficient manner and offer first-rate customer service to customers and licensed agents as well.

- Cigna’s policyholders do not have to deal with network constraints and can use any medical provider that will accept Original Medicare and there are no referral prerequisites when it comes to visiting a specialist.

- Not only does Cigna offer coverage for seniors located anyplace in the country, a few of their plan options offer coverage for medical expenses received outside the country.

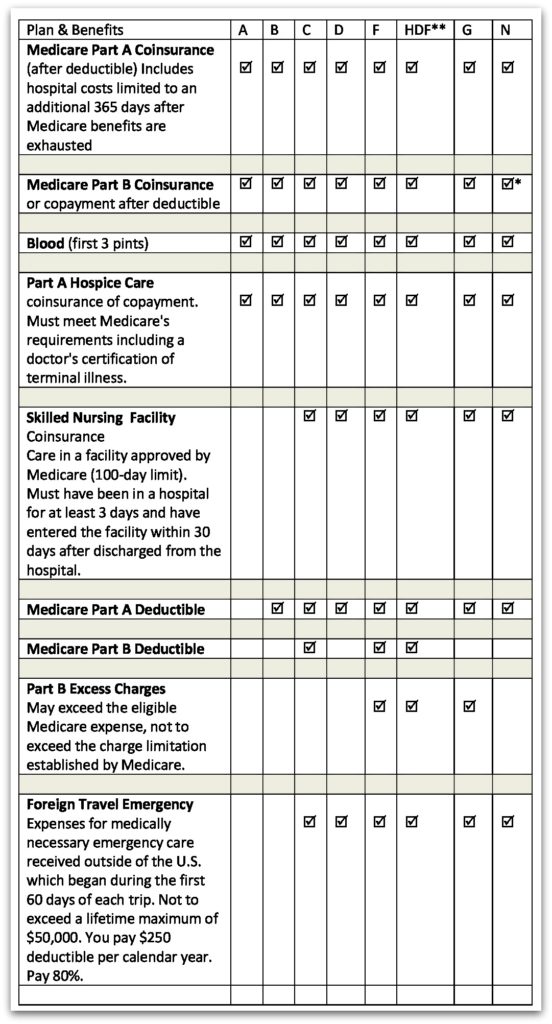

Cigna’s 2018 Medicare Supplement Plans

*Plan N pays 100% of the Part B coinsurance, except for a copayment not to exceed $20 for some office visits and a $50 copayment for emergency room visits that do not result in an inpatient admission.

**HDF (high deductible F) pays the same as Plan F and requires payment of your costs (coinsurance, copayments, deductibles) for Medicare-approved expenses up to the current calendar year deductible amount before the policy pays any benefits.

Cigna Plan F

Cigna’s Plan F is the most comprehensive plan available from the carrier and is the most preferred plan in the U.S. Presently, Cigna is stating that Plan F represents over 40 percent of the Medicare Supplement plans they have issued because Plan F considerably minimizes out-of-pocket health care costs.

Cigna Plan G

Now at 13% of Cigna’s Medicare Supplement sales, Plan G is dramatically gaining ground in acceptance among consumers. Given that the only difference between Plan G and Plan F is that Plan G does not offer coverage for Original Medicare’s Part B deductible and the lower rates make up for that particular lack in coverage.

Cigna Plan N

Third in line based on Cigna’s sales is Plan N mainly because policyholders can pay reduced rates and still have broad coverage. Plan N will cover the Part B deductible or excess charges that Plan F covers and there may be a small copayment for some doctor and specialist visits or emergency room visits.

Why Cigna is a Great Choice

As seniors will discover, there are many alternate options to consider when you are looking for Medicare Supplement insurance. And, although rates will typically pay a significant role in the decision-making process, the insurance company you choose and what that company has to offer as far as product selection and service should come in to play as well. Cigna has over the years been a frontrunner in the healthcare insurance market because of their consistent attention to the preferences of their policyholders.

Speak with an experienced advisor!

Speak with an experienced advisor!